From the beginning, Bitcoin’s rise has been nothing short of legendary. Priced at just $0.07 on August 17, 2010, it has skyrocketed $100,000+ into 2025, creating wealth, rewriting investment playbooks, and cementing its place as a cornerstone of the future financial system.

Bitcoin Magazine Pro data reveals that out of 5,442 total days since Bitcoin first began trading, 5,441 have been profitable when compared to today’s price, an extraordinary 99.98% success rate. For those who believed early and held through the volatility, the reward has been historic.

The analysis of Bitcoin’s daily price history also reveals that over 80 percent of all trading days have been profitable, meaning the current price is higher than the price on those days. This level of consistency has become a key reason why so many long term investors continue to hodl with confidence.

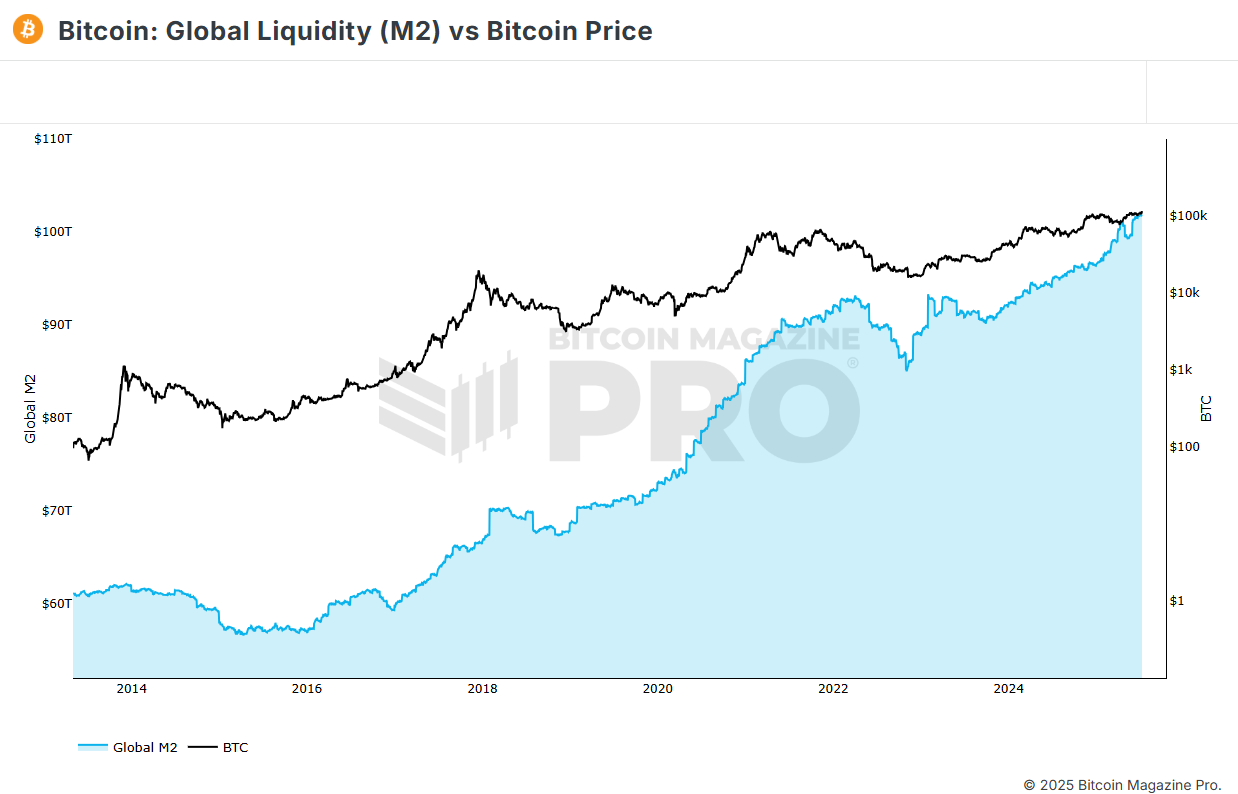

Since 2013, the global supply of money (M2) has grown from about $61 trillion to over $102 trillion. During that same period, Bitcoin’s price jumped from around $113 to more than $118,000 at its peak. This trend shows a strong connection between the increase in global money supply and the rise in Bitcoin’s value, supporting the idea that Bitcoin acts as a hedge against inflation and a reliable store of value.

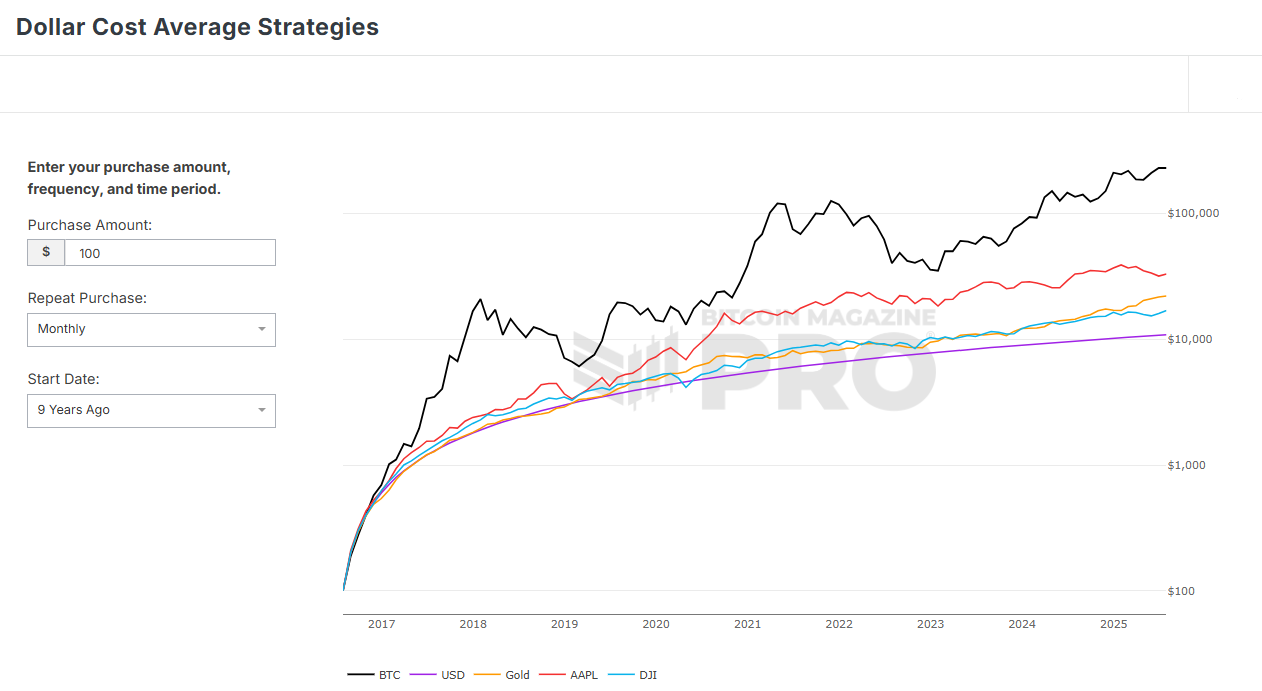

According to Bitcoin Magazine Pro, if you had dollar cost averaged (DCA) $100 a month into Bitcoin over the past nine years, you’d be sitting on over $230,670 today, from just a $10,900 total investment, with a return of over 2,016%.

In comparison, gold had returns of 103% which would have turned the investment of $10,900 into $22,152, Apple stock of 204% into $33,081, and Dow Jones Industrial (DJI) 56% into 16,993. Bitcoin easily surpasses the returns of traditional assets like gold, Apple stock, or the DJI.

The Dollar Cost Average Strategies tool from Bitcoin Magazine Pro helps users explore Bitcoin investments across different timeframes. By comparing Bitcoin’s performance to assets like the US dollar, gold, Apple stock, and the DJI, the tool highlights Bitcoin’s potential as a leading store of value within a diversified investment portfolio. Those interested in view Bitcoin Magazine Pro data can do so here.

Leave a Comment