Key Takeaways

- Strategy acquired 4,225 Bitcoin for $472 million, reaching a total of 601,550 BTC held.

- The acquisition was funded via ongoing stock sales.

Share this article

Michael Saylor’s Strategy has resumed its Bitcoin buying after a brief pause, pushing its total holdings to the 600,000 BTC milestone. The move further cements the company’s position as the largest corporate holder of Bitcoin.

According to a new SEC disclosure, the latest purchase came between July 7 and 13, when the firm added 4,225 BTC for approximately $472 million at an average price of $111,827 per coin, including fees.

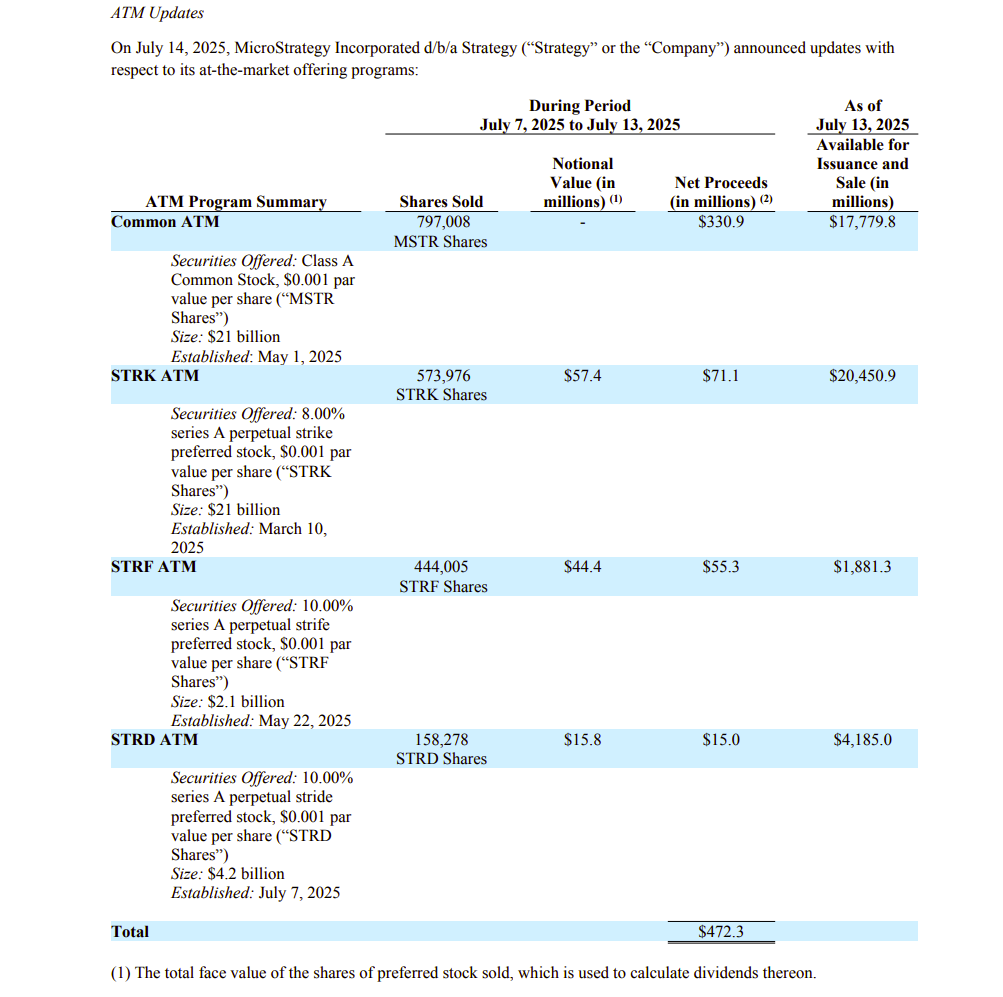

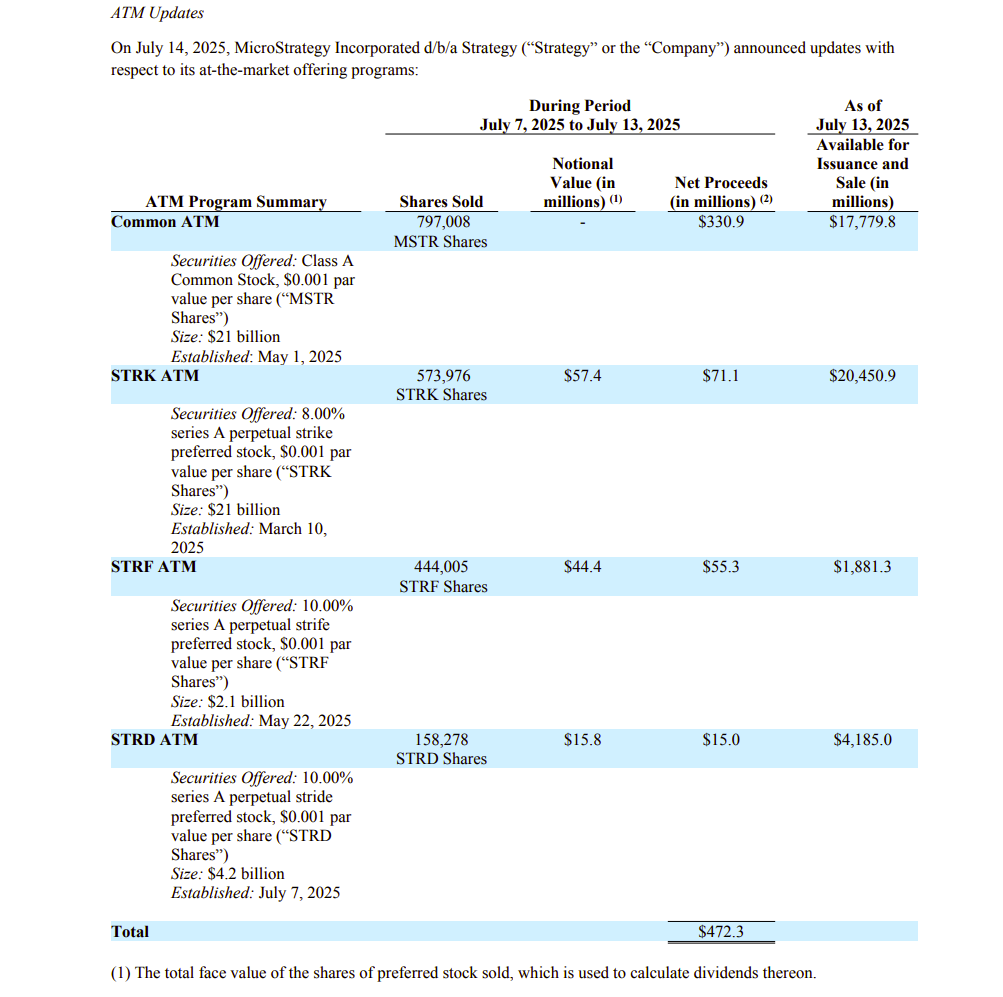

Strategy continues to fund its Bitcoin acquisitions through ongoing stock sales. In the same week, it sold over 797,000 shares of MSTR for nearly $331 million, along with over $141 million in shares of STRK, STRF, and STRD preferred stocks, adding fresh capital to support its Bitcoin strategy.

These sales are part of a broader fundraising program. Under its existing stock issuance plans, the company still has billions of dollars’ worth of shares authorized for sale.

Shares of Strategy (MSTR) closed up 3% last Friday. As of Monday morning, the stock was trading slightly higher in pre-market activity, according to Yahoo Finance.

Share this article

Leave a Comment