Key Takeaways

- The US House passed President Trump’s spending bill on Thursday; it’s now heading to Trump for his signature.

- The legislation includes tax cuts, increased discretionary spending, and safety-net program reductions.

Share this article

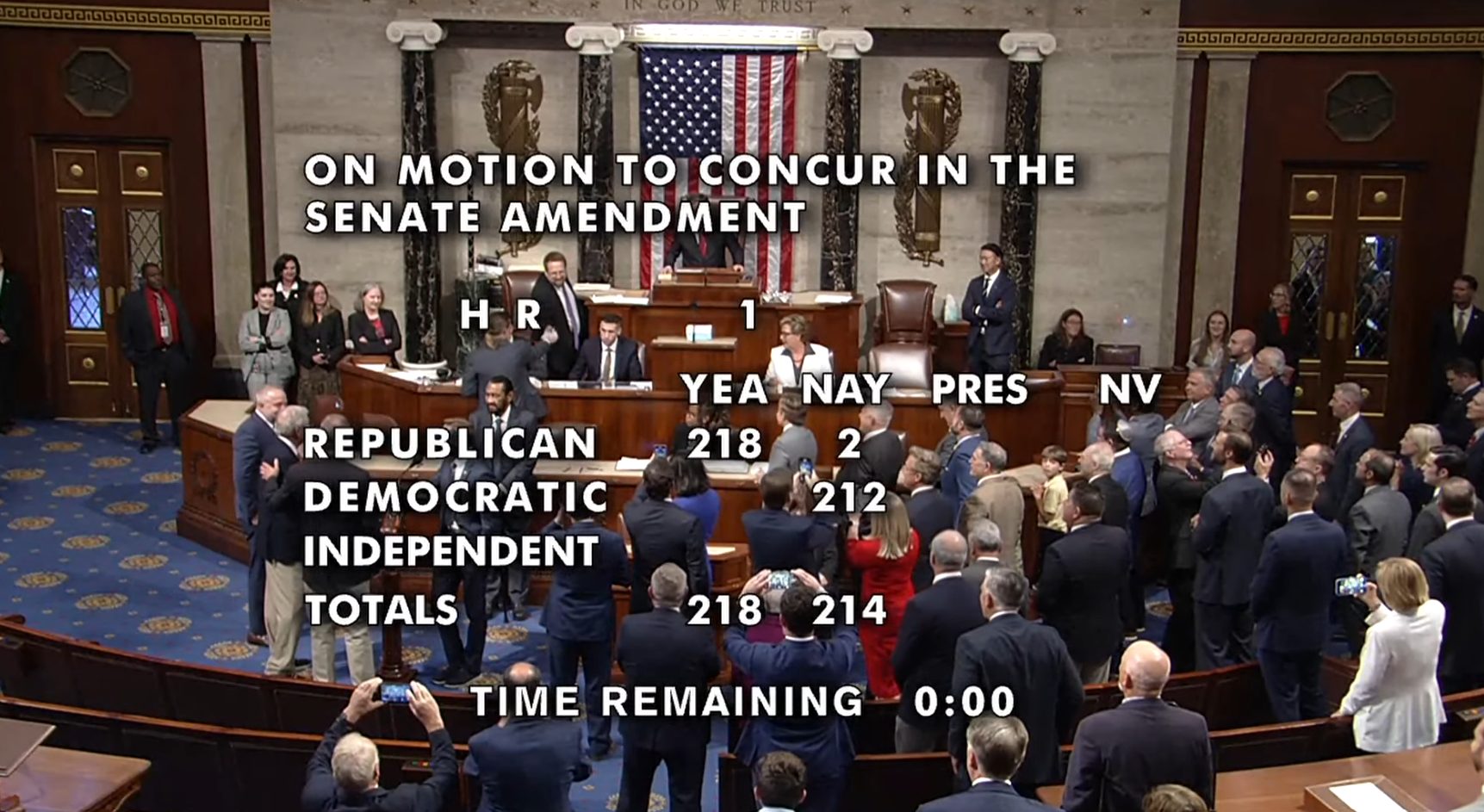

President Donald Trump’s flagship tax-and-spending legislation, the “Big Beautiful Bill,” cleared Congress on July 3 after passing the House of Representatives on a narrow 218-214 vote.

Two Republican representatives, Brian Fitzpatrick of Pennsylvania and Thomas Massie of Kentucky, crossed party lines to vote with Democrats against the measure, which had already cleared the Senate earlier this week.

The US Senate passed the bill without including proposed crypto tax amendments aimed at benefiting stakers, miners, and digital asset holders. Despite efforts by Senator Cynthia Lummis and other proponents, crypto-specific measures were left out due to time constraints during the bill’s final negotiations.

The legislation includes tax reductions for individuals and businesses, increases in discretionary spending, and cuts to safety-net programs. Financial analysts project that the bill could increase the national debt by $3.3 trillion over a decade.

House Democratic Leader Hakeem Jeffries set a chamber record for the longest speech during his floor protest against legislation.

The bill now heads to the White House for President Trump’s signature.

Bitcoin risks $90K retest as Trump’s bill sets the stage for liquidity squeeze

Arthur Hayes, co-founder of BitMEX and a prominent crypto analyst, predicts that President Trump’s Big Beautiful Bill, which raises the US debt ceiling, could cause a sizeable liquidity drain as the US Treasury refills its Treasury General Account (TGA).

This drain, estimated to be nearly $500 billion, could temporarily push Bitcoin’s price to retest the $90,000 to $95,000 range.

Despite potential short-term volatility, Hayes remains positive about Bitcoin’s long-term trajectory, suggesting that a smooth market absorption of the bond issuance could keep Bitcoin stable in the $100,000s.

Share this article

Leave a Comment