Summary

- Canary Capital filed for three new crypto related ETFs with the US SEC, including an American-made crypto ETF, on August 25.

- The filing document states that the new investment ETF is speculative and high-risk.

- The firm’s two other filings include the Trump coin and the Staked Injective ETF.

- The market capitalization of made in US cryptos is down nearly 5% in the past day.

- The 24-hour trade volume of the category exceeds $53 million, as of August 26.

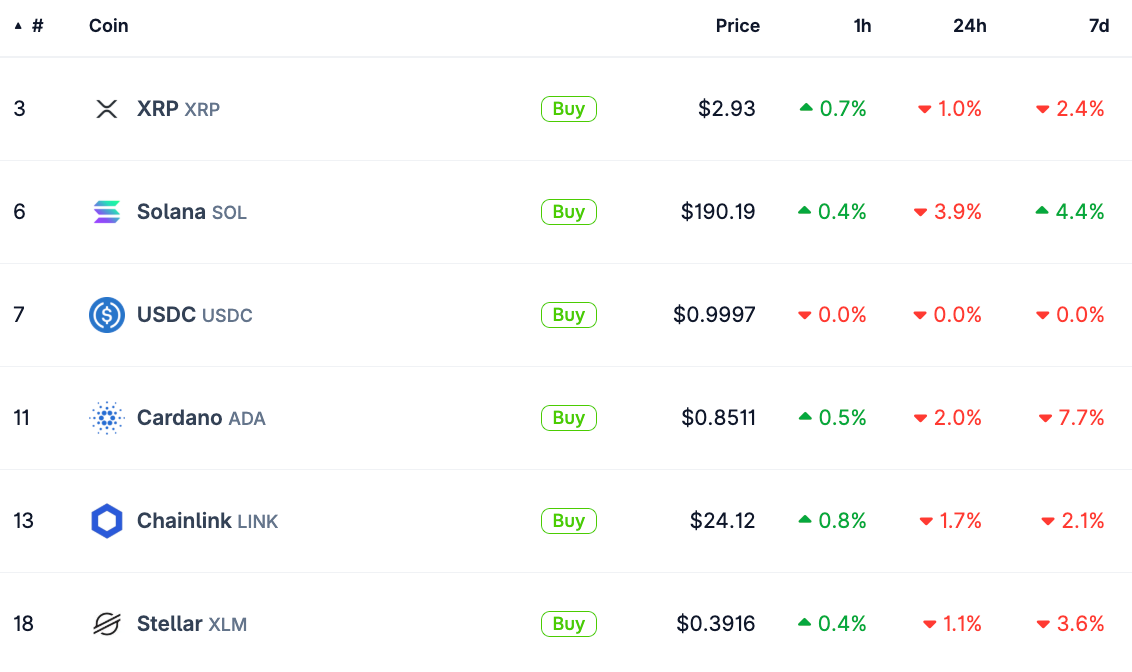

Canary Capital, a digital asset and crypto fund manager, filed for an American-made crypto ETF with the U.S. financial regulator, the SEC, fueling speculation of an “altcoin season” or gains in made-in-USA altcoins. In this deep dive, we analyze the impact of Canary’s American-made crypto ETF on tokens like XRP, Cardano, Chainlink, Solana, and Stellar, the top five cryptocurrencies in the made-in-USA category, ranked by market capitalization.

Canary Capitals SEC filing for proposed ETFs

The digital asset fund manager’s SEC filing reveals plans to invest in a portfolio of crypto assets that tracks the made-in-America blockchain index. The index will track cryptocurrencies originally created in the U.S., where a majority of the token’s supply was minted within the United States, and a majority of the protocol’s operations are U.S.-based.

The trust plans to generate rewards through the validation of transactions on the token’s native blockchain network, per the filing.

Canary Capital’s other filings, one for a Trump coin ETF and the other for a Staked Injective ETF, show that the digital asset manager is exploring several crypto-related investment products in the U.S. market. Currently, there is no fixed timeline for approval. The proposed investment products position Canary Capital as a fund focused on attracting U.S.-based crypto investors.

The filing mentions four crypto tokens, Ethereum (ETH), Cardano (ADA), Solana (SOL) and Avalanche (AVAX) as an example for Proof-of-Stake blockchains.

How Bitcoin and Ethereum ETFs impacted prices

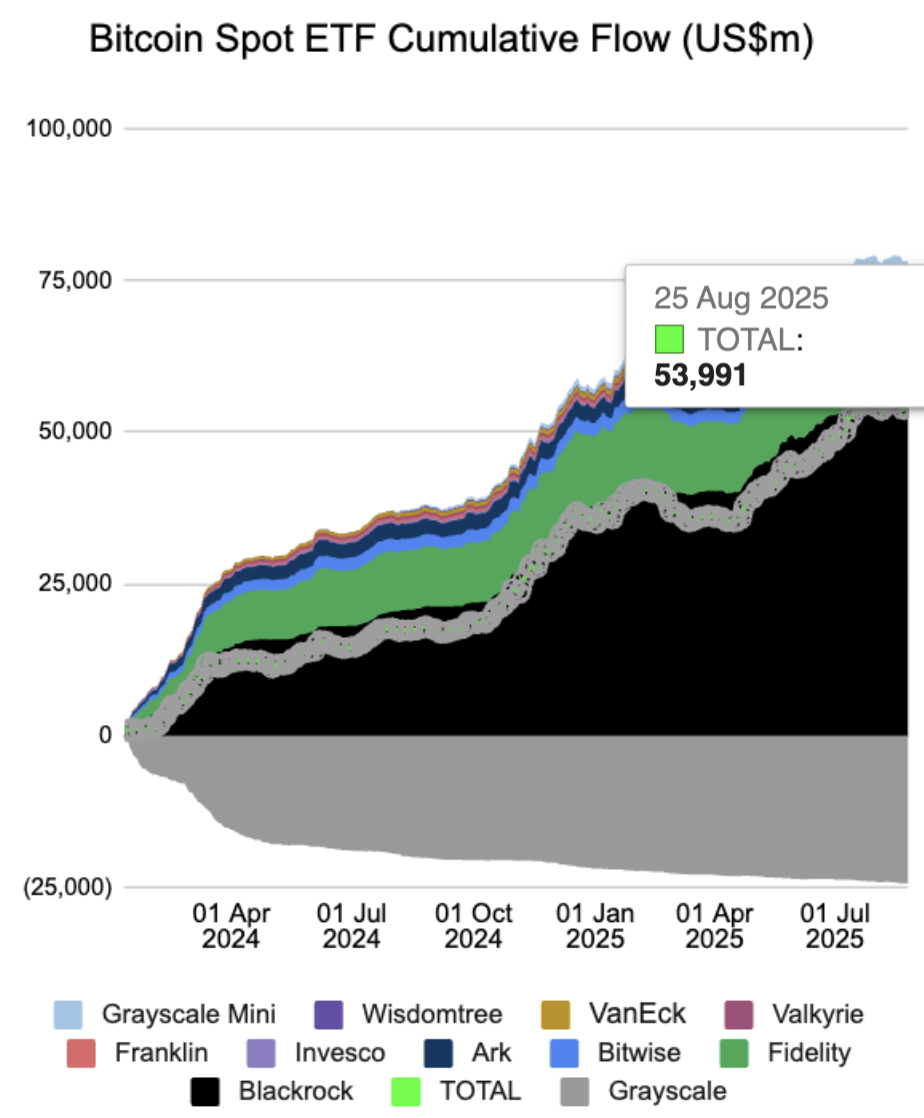

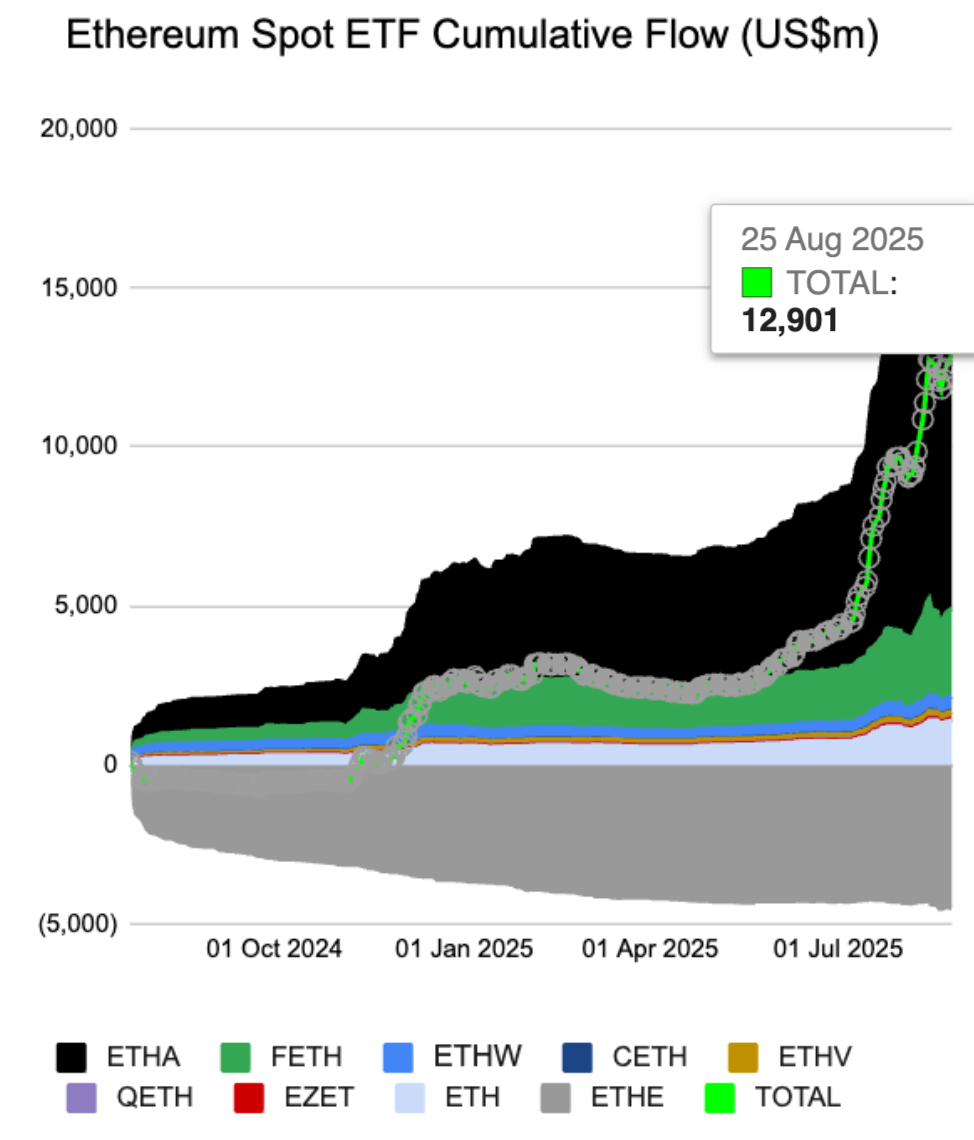

To ascertain the impact of an ETF on the underlying asset’s price, we draw a parallel with Bitcoin (BTC) and Ethereum spot ETFs in the U.S. Data from Farside Investors shows that a total of $53.99 billion in capital is the total flow of Bitcoin ETFs since their inception. Ethereum attracted over $12.90 billion in total flow.

Bitcoin price rallied with the rising flows and institutional demand catalyzed gains in the king crypto. While it took longer for the demand to fuel a rally in Ethereum, the token’s price increased and hit a new all-time high in August 2025.

If the pattern repeats itself, Canary Capital’s ETF could generate cumulative inflows that climb steadily over a period of time. Higher capital flows to the ETF could generate demand for tokens included in the index.

While Ethereum, Cardano, Solana and Avalanche are included in the filing, other top made in USA tokens like Chainlink (LINK) and Stellar (XLM) could be included.

Altcoin season catalysts

Canary Capital’s filing is likely the first in a series of crypto-focused ETFs to be filed with the SEC. This could be a catalyst for the altcoin season. The altcoin season begins when 75% of the top 50 cryptocurrencies by market capitalization outperform Bitcoin consistently for 90 days.

The key catalysts for the altcoin season are Bitcoin dominance hitting a plateau or declining, a rise in altcoin market capitalization, and institutional demand for tokens.

The altcoin market capitalization can be tracked using the crypto total market capitalization excluding Bitcoin. The value is $1.58 trillion as of August 26, and the 2021 cycle top corresponded to an altcoin market cap of $1.71 trillion.

Institutions following in Strategy’s footsteps and adding crypto tokens to their treasury could contribute to the demand for altcoins and catalyze gains in top cryptos. Ethereum and Binance Coin (BNB) recently hit their all-time highs; other cryptos could follow if demand persists alongside other catalysts.

Top 5 altcoins likely to gain

XRP, ADA, LINK, XLM, and SOL stand to gain from Canary Capital’s ETF filing, subject to the investment product’s approval by the SEC. If the U.S. financial regulator greenlights the ETF, it could open the path for similar investment products, offering institutional investors an opportunity to fuel demand for altcoins made in the USA.

Data from CoinGecko shows that the market capitalization of the made-in-USA tokens’ category is above $518.99 billion and the 24-hour trade volume exceeds $53.12 billion.

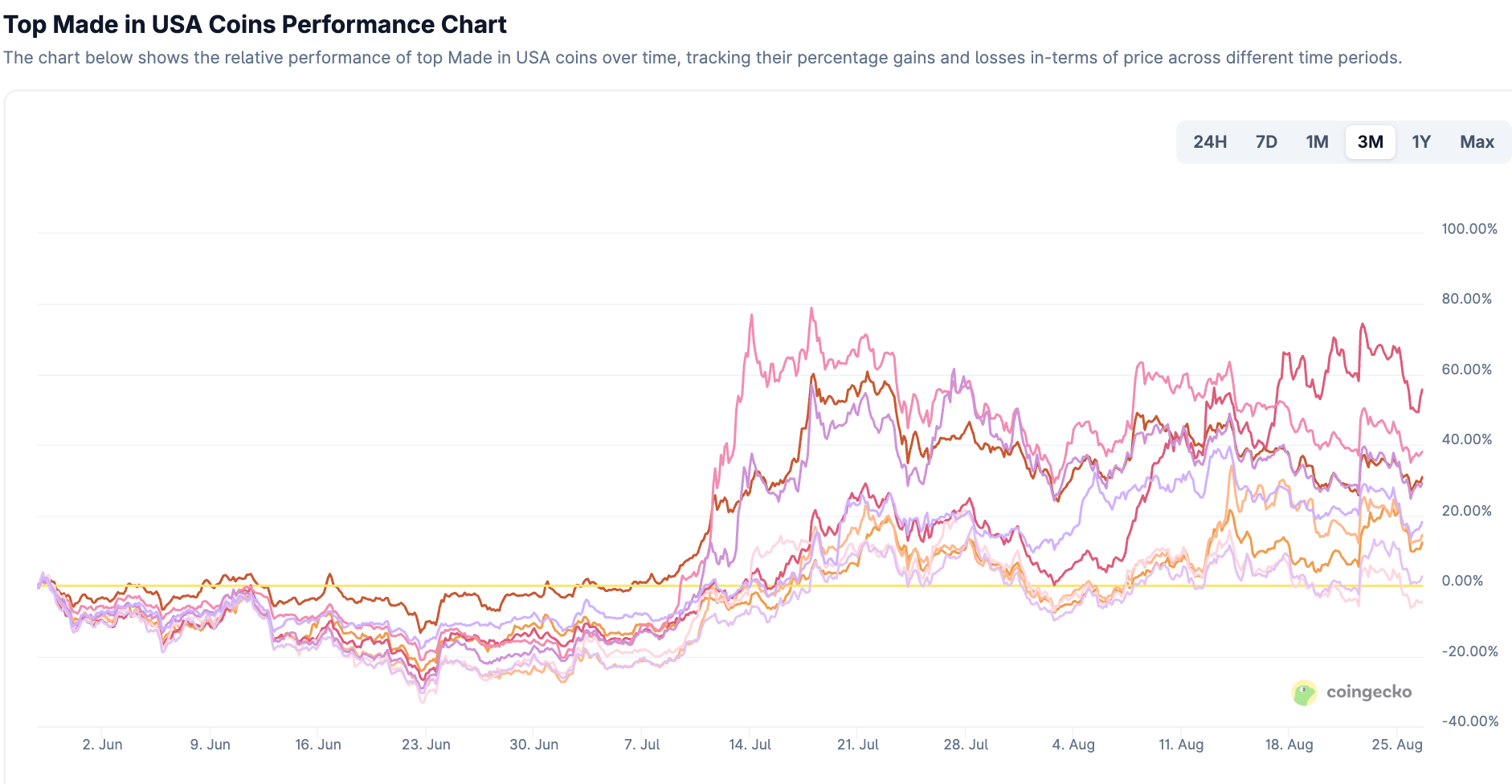

The price performance for the top made-in-USA coins over the past three months is seen in the chart below.

Why investors could be wary of Canary Capitals ETF

Canary Capital’s ETF raises concerns of capital loss among investors. The filing stresses that the investment is high-risk and investors could lose their investments. The ETF is not covered by the Commodity Exchange Act, a key federal law that regulates the commodity futures and options markets.

Canary Capital’s ETF is not regulated by the CFTC, and the product’s investors are not covered by the protection that crypto futures market investors have.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Leave a Comment